Education is a crucial stepping stone to a successful career, but for many students, the cost of tuition, books, and living expenses can seem like a daunting barrier. Fortunately, there are numerous funding programs available to help make education more affordable. From scholarships to loans, financial aid programs are designed to ease the burden of rising educational costs. This guide will take you through the different types of student funding programs, how to apply for them, and provide valuable insights into how to maximize your opportunities for securing financial support.

Introduction

Student funding programs are a lifeline for many individuals seeking higher education. These programs come in various forms, each designed to meet different financial needs. While scholarships and grants provide free money that does not need to be repaid, loans offer a way to borrow funds for your education, which must be repaid after you graduate. Navigating through the maze of funding options can be overwhelming, but understanding the available options can significantly ease your journey.

In this article, we will explore the different types of student funding programs available, how to apply for them, their benefits, potential risks, and how to avoid common pitfalls in the process. Whether you are a high school student looking to pursue higher education or a current student searching for financial assistance, this guide will provide the necessary information to help you find the right funding option for your needs.

What is Student Funding?

Student funding refers to the financial assistance provided to students to help them cover the cost of their education. These funds can be used for tuition, fees, textbooks, living expenses, and other associated costs. Student funding programs are offered by governments, private organizations, colleges and universities, and other entities to ensure that education remains accessible to individuals from all financial backgrounds.

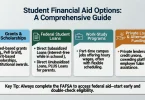

There are several types of student funding programs, including:

- Scholarships: These are financial awards given based on merit or need, and they do not need to be repaid.

- Grants: Similar to scholarships, grants are typically awarded based on financial need or other specific criteria and do not require repayment.

- Loans: Loans are funds that must be repaid with interest after graduation or after the student leaves school.

- Work-Study Programs: These programs allow students to work part-time while studying to help pay for their education.

Each type of funding has its eligibility requirements, application process, and repayment terms, which can vary depending on the provider. Understanding these options is essential to securing the right kind of financial support for your education.

Why are Student Funding Programs Important?

Student funding programs play a pivotal role in providing equal access to higher education. Here’s why they are so important:

1. Accessibility to Education

Not all students have the financial means to cover the high costs of college or university education. Student funding programs ensure that individuals from all backgrounds can attend school without the overwhelming burden of financial barriers.

2. Reduced Financial Stress

The availability of financial aid helps reduce the stress associated with paying for education, allowing students to focus on their studies instead of worrying about how to afford their tuition or living expenses.

3. Opportunities for Personal Growth

By securing funding, students gain the opportunity to pursue higher education, which opens doors to better job prospects, personal development, and long-term career success.

4. Promoting Diversity

Funding programs can also help foster diversity in educational settings by providing opportunities for students from various cultural, socioeconomic, and geographical backgrounds to access higher education.

5. Support for Specific Needs

Some funding programs are designed to support students with specific needs, such as those pursuing certain fields of study, underrepresented groups, or those who demonstrate academic excellence. This targeted funding can help support the career aspirations of these students.

Detailed Step-by-Step Guide to Securing Student Funding

Finding and applying for student funding programs requires careful planning. Here’s a step-by-step guide to help you navigate the process:

Step 1: Determine Your Funding Needs

Start by evaluating your total education costs. These costs include tuition, fees, books, housing, and any other expenses associated with your education. By understanding your financial needs, you can prioritize the types of funding programs that will be most beneficial.

Step 2: Research Available Funding Programs

There are countless funding programs available, so it’s important to spend time researching options. Some places to look for student funding include:

- Federal Government: Many countries offer federal grants, loans, and scholarships based on financial need or merit.

- State or Provincial Government: In addition to federal programs, there are often state-specific programs available to help students.

- Colleges and Universities: Most institutions offer their own funding programs, including scholarships, grants, and work-study opportunities.

- Private Organizations: Many businesses, foundations, and community organizations offer scholarships for students in specific fields of study or with specific interests.

Step 3: Understand Eligibility Requirements

Before applying for any funding program, it’s crucial to understand the eligibility requirements. Some funding programs may be based on merit, while others may be need-based. Review the criteria carefully to ensure you meet the necessary qualifications.

Step 4: Prepare the Necessary Documents

Many funding programs will require you to submit documents such as:

- Academic transcripts

- Letters of recommendation

- Personal statements or essays

- Proof of income (for need-based funding)

- SAT/ACT scores (for merit-based scholarships)

Be sure to gather these documents early to avoid last-minute stress.

Step 5: Submit Your Applications

Once you’ve identified the funding programs that you qualify for, it’s time to submit your applications. Be sure to follow the instructions carefully and submit your application by the deadline. Double-check that all required documents are included with your application.

Step 6: Await Notifications and Respond

After you’ve submitted your applications, be patient as funding organizations review the submissions. Once you receive notifications about whether or not you’ve been awarded funding, be sure to respond promptly and follow any next steps provided.

Step 7: Accept or Decline the Funding

If you are offered financial assistance, carefully review the terms and conditions before accepting. If you’re offered multiple sources of funding, you may need to decide which offer is the best fit for your needs.

Benefits of Student Funding Programs

- Non-repayable funds (scholarships, grants)

- Flexible repayment terms (loans)

- Increased access to higher education

- Reduced financial stress

- More career opportunities

Disadvantages/Risks of Student Funding Programs

- Debt (Loans): If you take out student loans, you will be required to repay them with interest, which can accumulate over time.

- Competitive Process: Some funding programs are highly competitive, and there is no guarantee you will receive the funding you apply for.

- Limited Availability: Many funding programs have limited funding and may only cover a portion of your total educational costs.

Common Mistakes to Avoid

- Missing Deadlines: Always be mindful of the deadlines for scholarship and loan applications.

- Not Applying for Enough Options: Don’t limit yourself to just one funding program. Apply for as many as you qualify for.

- Overlooking Terms and Conditions: Carefully review the terms of each funding program, especially for loans, to avoid surprises down the road.

FAQs

1. What is the difference between a scholarship and a grant?

Both scholarships and grants are forms of financial aid that do not need to be repaid. Scholarships are often awarded based on merit, while grants are typically based on financial need.

2. Can international students apply for funding?

Yes, many countries and institutions offer funding programs specifically for international students. Be sure to check the eligibility requirements for each program.

3. Are student loans easy to get?

Student loans are relatively easy to apply for, but they require careful consideration as they must be repaid with interest.

4. How do I apply for a student loan?

You can apply for student loans through your government’s student loan program or through private lenders. Make sure to check the eligibility requirements and interest rates.

5. Can I apply for multiple scholarships at the same time?

Yes, you can apply for as many scholarships as you are eligible for. Be sure to follow the specific instructions for each one.

6. How long does it take to find out if I received funding?

The timeline varies depending on the funding program. It can take anywhere from a few weeks to several months to receive a response.

Expert Tips & Bonus Points

- Start early: The earlier you begin researching and applying for funding, the better your chances of securing financial aid.

- Focus on niche scholarships: Many scholarships are available for specific fields of study, backgrounds, or talents. Narrowing your search to niche scholarships can increase your chances of winning.

- Stay organized: Keep track of deadlines and required documents for each application.

Conclusion

Student funding programs are essential resources for making education more affordable and accessible. Whether you are looking for scholarships, grants, loans, or work-study opportunities, understanding the various types of financial aid and how to apply for them can significantly ease the burden of educational costs. By following the steps outlined in this guide and avoiding common pitfalls, you can increase your chances of securing the funding you need to pursue your educational goals and build a successful future.