Introduction

When it comes to financing education, many students and their families face the challenge of funding their studies. Financial aid funding resources are a crucial component of making higher education accessible to all. Whether you’re aiming for a bachelor’s, master’s, or a professional certification, financial aid can help bridge the gap between your aspirations and reality. In this article, we will explore various financial aid resources available to students, how they can be applied for, and the benefits and limitations of each. By the end of this guide, you’ll be equipped with the knowledge to secure the financial support you need for your academic journey.

What is Financial Aid Funding?

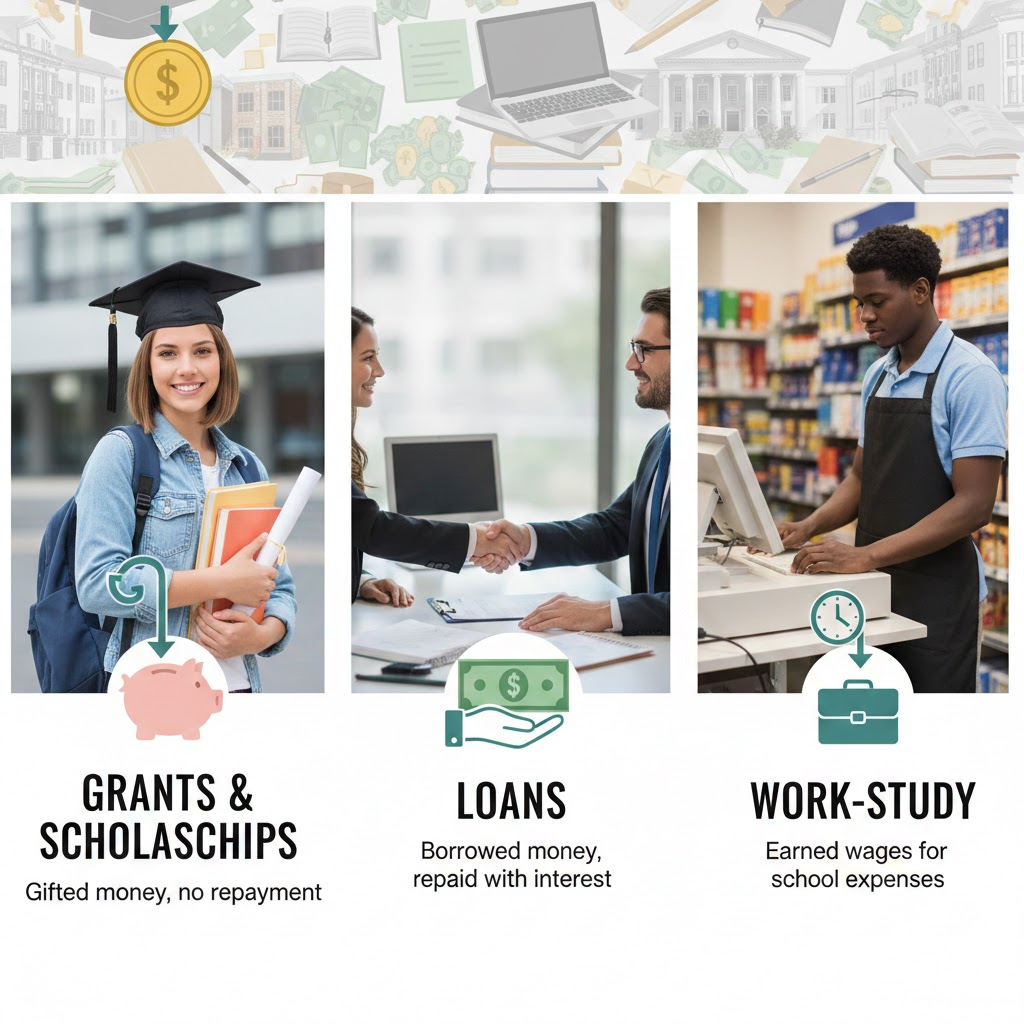

Financial aid funding refers to the various resources available to help students cover the cost of education. These funds can come from federal and state governments, colleges and universities, private organizations, and even employers. Financial aid typically comes in the form of scholarships, grants, loans, and work-study opportunities. Each of these resources is designed to reduce the financial burden of paying for education, but they vary significantly in terms of eligibility, application processes, and repayment requirements.

Why is Financial Aid Funding Important?

The cost of education has risen steadily in recent years, making it increasingly difficult for many students to afford tuition, books, housing, and other necessary expenses. Financial aid funding plays an essential role in making education accessible to all, regardless of economic background. Without financial aid, many students might be unable to attend college, let alone pursue advanced degrees or certifications.

By understanding and utilizing the available financial aid options, students can alleviate financial stress and focus on what truly matters: their education. Furthermore, the right financial aid resource can help students graduate without the burden of unmanageable debt, enabling them to begin their professional lives on a positive note.

Detailed Step-by-Step Guide to Financial Aid Funding

Step 1: Understand the Types of Financial Aid

Before diving into the application process, it’s important to understand the different types of financial aid available:

- Scholarships: These are awards based on merit, need, or specific characteristics (e.g., athletic ability, academic achievement, or background). Scholarships do not need to be repaid.

- Grants: Like scholarships, grants are typically need-based and do not require repayment. Federal and state governments often provide these grants.

- Loans: These are funds borrowed by students that must be repaid with interest. Federal student loans usually have lower interest rates and better repayment terms than private loans.

- Work-Study: This program allows students to work part-time while attending school, helping them cover some of their educational costs.

Step 2: Research Available Financial Aid Resources

Once you understand the types of aid available, it’s time to begin researching the financial aid options that are best suited to your needs.

- Federal Student Aid: In the United States, federal financial aid is often the first place to start. You can apply for this aid by completing the Free Application for Federal Student Aid (FAFSA), which is required to qualify for federal grants, loans, and work-study programs.

- State Financial Aid Programs: Many states offer their own financial aid programs. Research your state’s government website to find available grants, scholarships, or loan programs.

- Institutional Aid: Colleges and universities also offer their own financial aid programs. Check with the financial aid office at your school for any grants, scholarships, or work-study programs they may provide.

- Private Scholarships and Grants: Numerous organizations, foundations, and corporations offer scholarships and grants based on various criteria. Websites like Fastweb and Scholarships.com are great places to start your search.

Step 3: Apply for Financial Aid

- Complete the FAFSA: For U.S. students, the FAFSA is the primary step for obtaining federal and state financial aid. Fill it out as soon as possible to ensure you don’t miss out on any potential funds.

- Apply for Scholarships: Many scholarships require a separate application. Start by searching for scholarships related to your field of study, background, or academic achievements.

- Contact the Financial Aid Office: Reach out to your school’s financial aid office for assistance in navigating available options. They can also help you understand how to manage the financial aid you’re awarded.

Step 4: Review Your Financial Aid Award

Once you’ve applied, the next step is to review the financial aid award letter from your school. This document will outline how much aid you qualify for and the types of financial aid you’ll receive. Be sure to read the fine print, especially with loans, as repayment terms vary.

Benefits of Financial Aid Funding

- Reduced Financial Burden: Financial aid helps students cover tuition, books, housing, and other costs, reducing the need for personal savings or family contributions.

- Access to Higher Education: Financial aid resources make it possible for students from all economic backgrounds to attend college or university and pursue their career goals.

- No Repayment for Scholarships and Grants: Unlike loans, scholarships and grants do not require repayment, meaning students can pursue their education without the worry of accumulating debt.

- Work-Study Opportunities: Work-study programs provide students with part-time jobs that allow them to earn money while studying, which helps to manage daily expenses.

Disadvantages / Risks of Financial Aid

- Loan Debt: While loans are a necessary resource for many students, they come with the risk of accumulating debt that must be repaid with interest. Failure to repay loans can lead to serious financial consequences.

- Limited Availability: Not all students will qualify for financial aid, and some types of aid may have strict eligibility requirements.

- Time-Consuming Application Process: The financial aid application process can be lengthy and complex, requiring extensive documentation and follow-up. This can be overwhelming for some students.

Common Mistakes to Avoid When Applying for Financial Aid

- Missing Deadlines: Financial aid deadlines are crucial. Missing a deadline could result in the loss of financial aid opportunities.

- Not Completing the FAFSA: Even if you think you might not qualify, completing the FAFSA is essential. It’s the first step toward securing many types of aid.

- Focusing Only on Loans: While loans can help cover costs, it’s important to prioritize scholarships and grants, which do not require repayment.

- Not Keeping Track of Award Letters: Be sure to carefully review your award letter and follow up with your school’s financial aid office if you have any questions.

FAQs About Financial Aid Funding

1. What is the FAFSA, and why is it important?

The FAFSA (Free Application for Federal Student Aid) is a government form used to determine a student’s eligibility for federal financial aid, including grants, loans, and work-study programs. It’s crucial because it opens the door to many types of aid.

2. Do I need to pay back scholarships or grants?

No, scholarships and grants are typically “free money” that do not need to be repaid. However, some grants may have specific conditions you must meet to keep them.

3. Can international students apply for financial aid?

Yes, some forms of financial aid, like scholarships or institutional aid, may be available to international students. However, federal aid is generally not available to non-U.S. citizens.

4. How do I know if I’m eligible for financial aid?

Eligibility for financial aid depends on several factors, including income, family size, academic standing, and whether you are a U.S. citizen or eligible non-citizen. Completing the FAFSA is the first step in determining eligibility.

5. Can I apply for financial aid after the school year begins?

Yes, but it’s best to apply as early as possible to ensure you receive the full range of available aid. Many programs have limited funding.

6. What should I do if I am denied financial aid?

If you are denied financial aid, contact the financial aid office at your school for an explanation and inquire about other available options, such as private scholarships or work-study opportunities.

Expert Tips & Bonus Points

- Start Early: The earlier you start applying for financial aid, the more opportunities you’ll have to secure funding.

- Track Your Expenses: Create a budget to track your educational and living expenses. This will help you identify how much financial aid you need.

- Seek Outside Scholarships: Look for scholarships beyond those offered by your school. Many organizations, foundations, and companies offer financial aid resources.

- Consider Loan Repayment Options: If you must take out loans, research income-driven repayment plans and other loan forgiveness programs that may help you manage repayment.

Conclusion

Financial aid funding resources are essential for many students to achieve their academic goals. By understanding the various options available, applying early, and being diligent in managing your funds, you can ease the financial burden of education. Remember, scholarships, grants, loans, and work-study opportunities all play a vital role in helping you succeed without the weight of overwhelming debt. Start researching today, and take control of your financial future.