Introduction

Funding your education can seem like a daunting task, especially with the rising cost of tuition, books, and living expenses. Many students struggle to find ways to pay for their studies, leading to stress and sometimes even delaying their academic goals. However, with the right strategies and planning, funding your education can become manageable and even rewarding. Whether you are planning to attend college, university, vocational training, or online courses, there are several ways to secure the financial resources needed.

Understanding how to fund your education not only ensures that you can complete your studies without interruptions but also helps you develop financial discipline early in life. From scholarships and grants to part-time work and student loans, every option comes with its own set of benefits and challenges. By exploring all available avenues, creating a budget, and leveraging available resources, you can find a combination of methods that works best for your situation.

This guide will provide a detailed roadmap to help you navigate the complex world of education funding. You will learn what options exist, how to apply for financial aid, and how to make smart financial decisions that will reduce stress and maximize opportunities. With practical tips and expert advice, funding your education can transform from an overwhelming challenge into an achievable goal.

In this article, we will explore how to fund your education, covering everything from basic definitions to step-by-step strategies, benefits, risks, and expert insights. By the end, you will have a clear understanding of how to secure the funds needed to pursue your academic dreams successfully.

What is Funding Your Education?

Funding your education refers to the process of securing financial resources to pay for all costs associated with learning. These costs include tuition fees, textbooks, accommodation, transportation, and other living expenses while studying. Essentially, it is the combination of different sources of income or financial support that allows you to pursue your education without putting undue financial stress on yourself or your family.

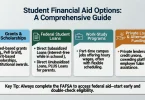

There are various methods to fund your education. Some of the most common include scholarships, grants, student loans, part-time jobs, crowdfunding, and support from family. Each method has different eligibility criteria, repayment requirements, and advantages. Some funding options are merit-based, meaning they reward academic or extracurricular achievements, while others are need-based, designed to assist students from low-income backgrounds.

Funding your education is not just about covering expenses; it is about making smart choices that will allow you to focus on your studies, build your future, and avoid unnecessary debt. For example, combining a small scholarship with a part-time job can significantly reduce the amount you need to borrow. Understanding these options is essential for long-term financial health and academic success.

Why is Funding Your Education Important?

Securing proper funding for your education is crucial for several reasons:

- Avoiding Student Debt: Without adequate funding, many students resort to high-interest loans that can burden them for years. Finding scholarships, grants, or part-time work can reduce the need for borrowing.

- Focus on Studies: Financial stress can negatively affect academic performance. When you know your education is funded, you can concentrate fully on learning.

- Access to Better Opportunities: Adequate funding allows you to attend better institutions, access advanced courses, and participate in extracurricular activities that enhance your skills.

- Financial Planning Skills: Learning how to fund your education teaches budgeting, financial management, and responsible spending. These are valuable skills for life beyond academics.

- Flexibility and Independence: Having your education funded, whether partially or fully, gives you independence to make academic and career decisions without being forced by financial constraints.

In summary, understanding how to fund your education empowers students to make informed decisions, reduces stress, and opens doors to opportunities that might otherwise be inaccessible.

Detailed Step-by-Step Guide to Funding Your Education

Funding your education can be achieved through multiple strategies. Below is a step-by-step guide to help you maximize your resources.

Step 1: Assess Your Financial Needs

Before looking for funding, determine how much money you will need. Consider:

- Tuition fees for your course or program

- Books, materials, and supplies

- Accommodation and utilities

- Transportation costs

- Personal expenses and emergencies

Creating a detailed budget helps you understand how much funding you require and identify potential gaps that need to be filled.

Step 2: Explore Scholarships

Scholarships are financial awards that do not require repayment. They can be merit-based, need-based, or specific to certain fields or demographics. Steps to apply include:

- Research scholarships offered by universities, private organizations, and governments

- Prepare a strong application with transcripts, letters of recommendation, and personal statements

- Meet deadlines carefully and tailor your applications to each scholarship

For example, if you are studying engineering, you may find scholarships specifically designed for students pursuing STEM degrees.

Step 3: Apply for Grants

Grants are similar to scholarships in that they do not need to be repaid. They are often awarded based on financial need rather than academic merit. Common types include:

- Government grants

- Institutional grants provided by colleges or universities

- Nonprofit organization grants

Make sure to research eligibility criteria thoroughly and submit complete documentation to increase your chances of receiving a grant.

Step 4: Consider Student Loans

Student loans provide immediate funding but must be repaid with interest. They are useful if scholarships and grants do not cover all expenses. Tips for managing student loans:

- Borrow only what you need

- Compare interest rates and repayment terms

- Understand federal vs. private loan differences

- Plan for repayment after graduation

For instance, federal student loans often have lower interest rates and flexible repayment options compared to private loans.

Step 5: Explore Part-Time Work and Internships

Working while studying can supplement your income and reduce reliance on loans. Options include:

- On-campus jobs such as library assistant or lab technician

- Freelancing in your field of study

- Paid internships that also provide professional experience

Balancing work and study is essential. Prioritize flexible jobs that accommodate your academic schedule.

Step 6: Crowdfunding and Community Support

Crowdfunding platforms allow you to raise funds for education from family, friends, or even strangers. To succeed:

- Share a compelling story about your educational goals

- Set a realistic funding target

- Promote your campaign through social media and community networks

Additionally, some communities or religious organizations provide sponsorships or small grants to students in need.

Step 7: Consider Savings and Personal Investments

If possible, save money before starting your studies. Even small savings over time can contribute significantly to tuition or living expenses. Other options include:

- Education savings accounts

- Investment plans that mature before your academic program

- Family contributions or pooled savings

Starting early ensures you have a financial cushion when needed.

Step 8: Combine Multiple Funding Sources

The most effective strategy is often a combination of scholarships, grants, loans, part-time work, and personal savings. For example:

- 40% scholarship

- 30% part-time work income

- 20% grant

- 10% personal savings

This approach reduces dependency on loans and spreads financial risk.

Benefits of Funding Your Education

Funding your education has numerous advantages:

- Reduces financial stress and anxiety

- Provides access to better academic programs

- Enhances focus and performance in studies

- Encourages financial discipline and planning

- Opens doors to professional opportunities through scholarships and internships

- Allows flexibility in choosing your courses and institutions

Proper funding ensures you can fully immerse yourself in your education without worrying constantly about money.

Disadvantages / Risks

While funding your education has benefits, there are some potential drawbacks:

- Debt Accumulation: Student loans can lead to long-term financial obligations if not managed properly

- Time Management Challenges: Working part-time may interfere with academic responsibilities

- Eligibility Limitations: Not all students qualify for scholarships or grants

- Application Stress: Competing for limited funding opportunities can be stressful and time-consuming

- Unreliable Funding Sources: Crowdfunding or community support may not always meet expectations

Being aware of these risks allows you to plan proactively and minimize negative impacts.

Common Mistakes to Avoid

- Relying on a Single Source of Funding: Depending solely on loans or scholarships can leave gaps in your finances.

- Missing Deadlines: Scholarship and grant applications have strict deadlines; missing them can result in lost opportunities.

- Ignoring Loan Terms: Not understanding repayment schedules, interest rates, or penalties can lead to financial trouble.

- Overworking While Studying: Taking on too many jobs can harm academic performance and health.

- Failing to Budget: Without careful budgeting, even sufficient funds can run out quickly.

- Not Researching Funding Options Thoroughly: Many students miss out on available grants or scholarships simply because they don’t research.

Avoiding these mistakes ensures your funding strategy is effective and sustainable.

FAQs About Funding Your Education

1. What is the easiest way to fund education for beginners?

The easiest starting point is scholarships and grants, as they do not require repayment and are widely available for various academic levels.

2. Can part-time work fully fund my education?

Part-time work can significantly contribute to funding but may not cover all expenses. Combining work with scholarships or loans is often necessary.

3. Are student loans risky?

Loans carry the risk of debt, but if borrowed responsibly, they can be manageable. Federal loans typically offer flexible repayment options, reducing the risk.

4. How do I find scholarships I am eligible for?

Research online databases, university websites, nonprofit organizations, and government programs. Tailor your applications to your achievements and needs.

5. Can crowdfunding actually work for education?

Yes, crowdfunding can work if you create a compelling story, engage your network, and promote your campaign widely. Success depends on effort and reach.

6. Are grants only for low-income students?

While many grants are need-based, some are also available for specific fields, research projects, or underrepresented groups. Check eligibility criteria carefully.

7. Should I start saving for education early?

Yes, early savings, even in small amounts, can reduce reliance on loans and provide a financial safety net.

8. Can family contributions count as funding?

Absolutely. Family support, whether through savings, gifts, or sponsorship, is a valid source of funding for education.

9. Is combining multiple funding sources beneficial?

Yes, combining scholarships, part-time work, grants, and loans spreads financial risk and reduces dependency on a single source.

10. How do I manage funds effectively while studying?

Create a monthly budget, track expenses, and prioritize essential costs. Use leftover funds for savings or emergencies.

Expert Tips & Bonus Points

- Start Early: Begin researching scholarships, grants, and loan options at least a year before your program starts.

- Apply Widely: Don’t limit yourself to one funding option; apply to multiple scholarships and grants.

- Maintain Good Grades: Academic performance often influences eligibility for scholarships and merit-based grants.

- Network and Seek Guidance: Talk to school counselors, professors, or financial aid offices for advice.

- Keep Organized Records: Track application deadlines, submission requirements, and follow-ups to avoid missing opportunities.

- Consider Alternative Programs: Online courses or community colleges may offer lower costs and flexible funding options.

- Negotiate When Possible: Some institutions allow tuition negotiation or installment plans. Don’t hesitate to ask.

- Leverage Skills for Income: Freelancing, tutoring, or online services can supplement income without interfering with studies.

Conclusion

Funding your education is a critical step toward achieving your academic and professional goals. It requires careful planning, research, and strategic action. By exploring scholarships, grants, loans, part-time work, savings, and community support, students can secure the financial resources needed to pursue their studies without undue stress. The process not only ensures access to education but also teaches valuable financial management skills that last a lifetime.

Successfully funding your education means combining multiple strategies, avoiding common pitfalls, and staying proactive in seeking opportunities. Whether through merit-based scholarships, need-based grants, student loans, or personal savings, every option contributes to building a sustainable funding plan. With persistence, organization, and smart decision-making, funding your education is achievable for every student.

By following the steps outlined in this guide, you can turn the challenge of paying for education into a manageable and even empowering experience. Remember, securing funding is not just about money; it’s about creating opportunities, reducing stress, and building a strong foundation for your future success