Introduction

Paying for education has become a serious concern for students and families around the world. Tuition fees, books, accommodation, and daily living costs can quickly add up. Because of this, understanding education funding options is no longer a luxury, but a real necessity. Many learners delay or even give up on their dreams simply because they do not know how to manage education costs Funding properly.

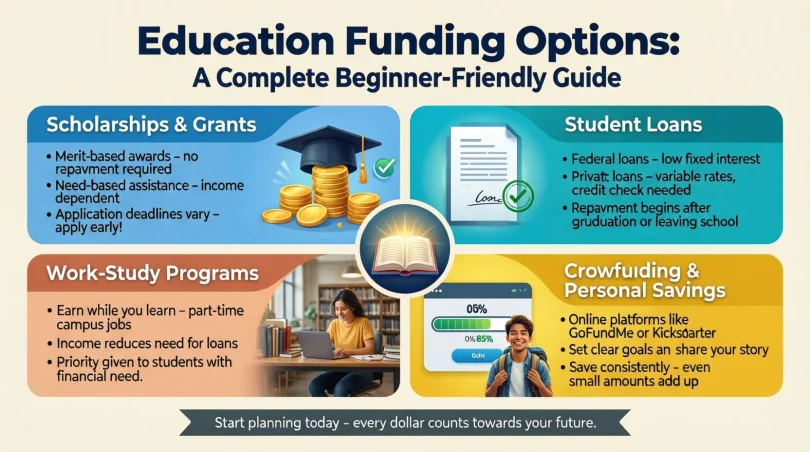

Education funding options help students continue learning without constant financial stress. These options are designed for different needs, backgrounds, and income levels. Some are based on merit, while others depend on financial need or career goals. When used wisely, they can reduce the burden on families and open doors to better opportunities.

For beginners, the topic may seem confusing at first. There are grants, loans, scholarships, and many other choices. Each option works differently and comes with its own rules. Intermediate readers may already know a few methods, but still struggle to choose the right one.

This guide explains education funding options in a simple and practical way. It focuses on clarity, real examples, and step-by-step explanations. By the end, you will understand how these options work, why they matter, and how to avoid common mistakes. Most importantly, you will gain confidence to plan your education finances smartly and responsibly.

What is Education Funding Options?

Education funding options refer to the different ways students and families can pay for education expenses. These expenses include tuition fees, examination charges, learning materials, housing, and other related costs. Instead of paying everything from personal savings, learners use structured financial support methods.

These options come from various sources. Governments, private organizations, educational institutions, and financial institutions all play a role. Some funding methods provide free money that does not need repayment. Others offer financial help that must be repaid over time.

Education funding options are not limited to higher education. They are available for schools, colleges, universities, vocational training, and professional courses. Each level of education may have different funding opportunities.

Understanding these options helps students make informed decisions. It allows them to select programs based on interest and career goals rather than financial limits. In simple terms, education funding options act as a bridge between ambition and affordability.

Why is Education Funding Options Important?

Education funding options are important because they make learning accessible to more people. Without financial support, education would only be available to those who can afford high costs.

These options reduce the pressure on families. Parents do not have to exhaust savings or take risky financial steps. Students can focus on learning instead of worrying about money.

Another key reason is equal opportunity. Education funding options support talented students from low-income backgrounds. This creates a fair system where success depends on ability, not wealth.

They also support national development. Educated individuals contribute better skills to society. Governments invest in education funding because it builds a stronger workforce and economy.

Lastly, these options encourage lifelong learning. People can return to education later in life, upgrade skills, and change careers without fear of financial barriers.

Detailed Step-by-Step Guide

Step 1: Understand Your Education Costs

Start by listing all expected expenses. Include tuition, books, transport, housing, and daily needs. Knowing the total cost helps you choose the right funding mix.

Step 2: Explore Free Funding Sources

Look for grants and scholarships first. These are the best education funding options because they do not require repayment. Check eligibility rules carefully.

Step 3: Check Government Programs

Many governments offer student aid programs. These may include grants, subsidized loans, or fee support. Apply early because deadlines are strict.

Step 4: Consider Institutional Support

Universities and colleges often provide internal funding. This may be based on merit, need, or specific subjects. Contact the financial aid office for details.

Step 5: Evaluate Education Loans

Loans are common education funding options but must be used carefully. Compare interest rates, repayment terms, and grace periods before choosing.

Step 6: Look into Work-Study Options

Some programs allow students to work part-time while studying. This helps cover living expenses and builds experience.

Step 7: Combine Multiple Options

Most students use a mix of education funding options. Combining grants, scholarships, and part-time work reduces loan dependence.

Step 8: Plan Repayment Early

If you take loans, plan repayment from the start. Understand monthly payments and future income expectations.

Benefits of Education Funding Options

- Make education affordable for all income levels

- Reduce financial stress for students and families

- Encourage higher enrollment in education

- Support talented students with limited resources

- Allow focus on learning instead of money worries

- Promote career growth and skill development

- Enable access to quality institutions

- Support lifelong learning goals

Disadvantages / Risks

- Some loans create long-term debt

- Misunderstanding terms can cause financial problems

- Limited funding availability for certain fields

- Competitive scholarships can be hard to secure

- Poor planning may lead to over-borrowing

- Changing rules may affect funding continuity

Common Mistakes to Avoid

Many students apply late and miss deadlines. This reduces available choices. Always check dates early.

Another mistake is relying only on loans. Ignoring free education funding options increases future debt.

Some learners do not read terms carefully. This leads to unexpected repayment conditions later.

Overestimating future income is also risky. Borrowing too much can cause stress after graduation.

Lastly, not asking for guidance is a common error. Financial aid offices and counselors exist to help.

FAQs

What are the most common education funding options?

The most common education funding options include scholarships, grants, student loans, work-study programs, and family savings. Each option serves different needs and situations.

Are education funding options available for online courses?

Yes, many online programs qualify for funding. Government aid, institutional scholarships, and private grants often support online education.

Do I need to repay all education funding options?

No. Scholarships and grants usually do not require repayment. Loans, however, must be repaid with interest.

Can I use multiple education funding options together?

Yes, combining options is common. Many students use scholarships, part-time work, and loans together.

How early should I apply for funding?

Apply as early as possible. Many programs have limited funds and strict deadlines.

Are education funding options only for young students?

No. Adults, professionals, and career changers can also access many education funding options.

Expert Tips & Bonus Points

Start researching at least one year in advance. Early planning increases success.

Keep documents organized. Applications often require proof of income and academic records.

Apply even if you think you may not qualify. Many students miss opportunities due to self-doubt.

Review funding every year. New education funding options may become available.

Maintain good academic performance. Many programs require ongoing eligibility.

Seek advice from financial counselors. Expert guidance prevents costly mistakes.

Conclusion

Education funding options play a vital role in shaping a student’s future. They remove financial barriers and make learning achievable for people from all backgrounds. With the right approach, students can focus on growth instead of stress.

Understanding available choices is the first step. From scholarships and grants to loans and work-study programs, each option has a purpose. Smart planning allows students to combine these resources effectively.

It is important to stay informed and proactive. Rules change, and new opportunities appear regularly. Students who research early and apply carefully gain a strong advantage.

In the long run, education funding options are investments in personal and professional success. They support skill development, career advancement, and confidence. By making informed decisions today, learners can build a secure and successful tomorrow.